Top Advantages of Forex Trading You Should Know

Forex trading has gained immense popularity among both novice and experienced investors due to the benefits it offers over other financial markets. One of the key elements of getting started in forex is choosing a reputable broker. For those in the Middle East, advantages of forex trading Kuwait Brokers can provide valuable resources and insights. In this article, we will delve into the advantages of forex trading and why it is considered an attractive option for numerous traders worldwide.

1. High Liquidity

The foreign exchange market is known for its high liquidity, with an average daily trading volume exceeding $6 trillion. This astonishing liquidity allows traders to execute large transactions without significantly impacting market prices. High liquidity ensures that traders can enter or exit trades at any time during market hours, thus providing the flexibility to manage their positions effectively.

2. Accessibility

Forex trading is highly accessible due to its 24-hour market operation during the weekdays. Unlike stock markets that operate within fixed hours, the forex market allows traders from different time zones to participate whenever they wish. This flexibility makes it easier for individuals with full-time jobs or other commitments to engage in trading, allowing them to gain exposure to the foreign exchange market without disrupting their daily activities.

3. Low Transaction Costs

Another significant advantage of forex trading is the low transaction costs associated with it. Most brokers offer tight spreads for currency pairs, meaning traders can enter and exit positions with minimal costs. There are typically no commissions on forex trades, making it affordable for traders to execute multiple trades in a day without incurring substantial fees.

4. Leverage Opportunities

Forex trading allows traders to use leverage, which enables them to control larger positions with a relatively small amount of capital. For instance, a leverage ratio of 100:1 means that for every $1 of their own money, traders can control $100 in the market. While leverage can amplify potential gains, it is essential to understand that it also increases the risk of losses. Proper risk management strategies should always be employed.

5. Diverse Trading Options

The forex market offers a wide array of currency pairs to trade, providing ample opportunities for diversification. Traders can choose from major pairs like EUR/USD and GBP/USD, as well as exotic pairs like USD/TRY or AUD/SGD. This variety allows traders to implement different trading strategies, whether they prefer to focus on strong economies or markets with higher volatility.

6. Technical and Fundamental Analysis

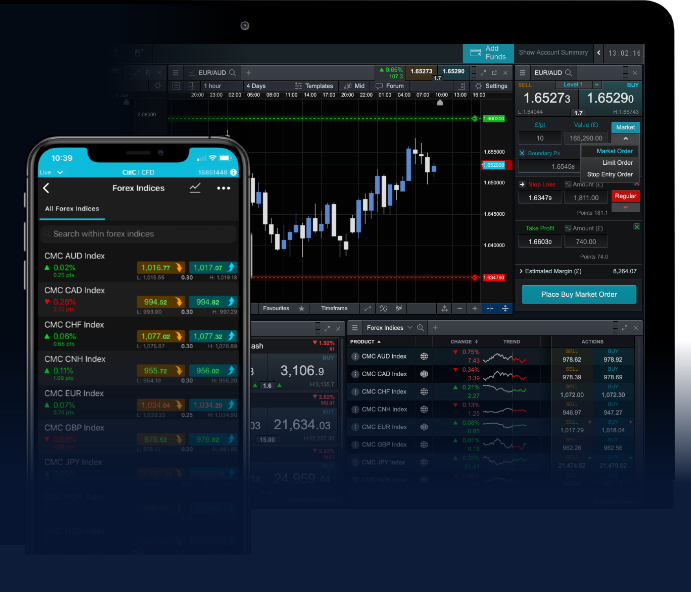

Forex trading provides numerous resources for both technical and fundamental analysis. Traders can analyze economic indicators, geopolitical events, and central bank decisions that influence currency movements. Additionally, various charting tools and indicators are available to help traders make informed decisions. This wealth of information helps traders develop effective strategies tailored to their goals and market conditions.

7. Community Support and Education

The forex trading community is vast and diverse, offering traders access to various forums, blogs, webinars, and educational resources. Many brokers also provide tutorials and demo accounts to help new traders learn the ropes before diving into real trading. This support network facilitates learning, allowing traders to share experiences and strategies that can enhance their trading skills over time.

8. Ability to Profit in Rising and Falling Markets

In forex trading, traders can take advantage of both rising and falling markets. By going long or short on currency pairs, they have the opportunity to profit in various market conditions. This flexibility is not always available in traditional equity markets, where traders typically benefit only from rising prices. As such, forex trading presents unique potential for profit under different economic circumstances.

9. Automation and Algorithmic Trading

Advancements in technology have led to the rise of automated trading systems and algorithmic trading in forex. Traders can utilize trading bots to execute trades based on predefined criteria, eliminating emotional decisions and allowing for more disciplined trading. Moreover, algorithmic trading can analyze huge volumes of data, ensuring that traders capitalize on opportunities quickly and efficiently.

10. Tax Advantages

In many jurisdictions, profits from forex trading are treated differently than capital gains from stock trading. This can lead to tax advantages for forex traders, allowing them to retain a larger portion of their earnings. However, it is crucial to consult a tax advisor to understand the specific regulations that apply to individual circumstances.

Conclusion

Forex trading presents a compelling avenue for individuals looking to engage in the financial markets. With high liquidity, low transaction costs, and opportunities for profit in various market conditions, it stands out as a unique investment option. The accessibility and resources available to both new and experienced traders further enhance its appeal. As with any investment, it is vital to approach forex trading with careful planning, education, and risk management to maximize potential benefits while minimizing risks.