In recent years, Islamic forex trading has gained momentum among Muslim traders around the globe. As financial markets continue to evolve, the demand for trading options that comply with Islamic principles, specifically Shariah law, has become increasingly significant. This article will delve into the intricacies of Islamic forex trading, exploring its basic principles, the rules governing it, and how it differs from traditional forex trading. For more information, visit islamic forex trading https://tradingarea-ng.com/.

What is Islamic Forex Trading?

Islamic Forex trading refers to the practice of trading currencies in a manner that is consistent with Islamic law. The core tenet of Islamic finance is the prohibition of riba (interest), which is a fundamental aspect that affects how forex trading is conducted. Traditional forex trading often involves interest in the form of overnight fees or swap rates, which are not permissible in Islamic finance.

The Basics of Forex Trading

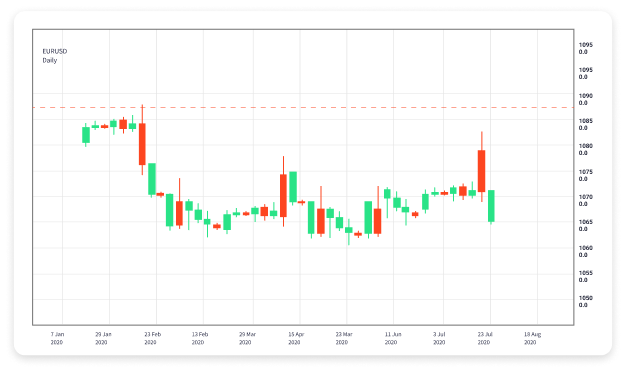

Before diving into Islamic Forex trading, it is essential to understand what forex trading entails. Forex, or foreign exchange, is the global market where currencies are traded. It operates 24/5 and involves buying one currency while simultaneously selling another. Traders aim to profit from the fluctuations in currency values.

Principles of Islamic Finance

Islamic finance is guided by several principles, including:

- Prohibition of Riba: Any form of interest is forbidden.

- Transparency: All transactions should be clear and transparent.

- Risk Sharing: Financial transactions should involve risk-sharing between parties.

- Ethical Investments: Investments should only be made in activities and sectors that are considered halal (permissible) according to Islamic law.

Halal Forex Trading

In the context of forex trading, this means finding a trading platform that offers Islamic accounts, which are designed to adhere to Shariah law. These accounts do not involve any interest payments or swap fees, making them compliant with Islamic values. Instead of swap fees, Islamic accounts use other methods to facilitate trading without falling into riba.

How to Trade Forex Islamically

To engage in Islamic forex trading, it is crucial to follow these steps:

- Choose an Islamic Forex Broker: Select a broker that offers Islamic accounts without swap fees. Many reputable brokers provide this option, which is essential for halal trading.

- Understand Forex Market Mechanics: Learn the basics of forex trading, including understanding currency pairs, market analysis (technical and fundamental), and trading strategies.

- Utilize Risk Management: Effective risk management strategies are vital in forex trading. This includes setting stop-loss orders and managing your account leverage responsibly.

- Stay Updated: The forex market is influenced by various factors, including economic indicators and geopolitical events. Staying informed about market news can help you make informed trading decisions.

- Consult Scholars as Needed: If you are unsure about specific trading practices or instruments, it may be wise to consult a scholar knowledgeable in Islamic finance for guidance.

Common Practices in Islamic Forex Trading

Here are some common practices that traders should consider when trading forex in compliance with Islamic law:

- No Leverage Beyond Permissible Limits: While leverage is a common practice in forex trading, it should be used cautiously to avoid excessive risk.

- Long-Term Trading: Swing trading or long-term trading strategies may be more aligned with Islamic principles than short-term or day trading.

- Avoiding Speculative Instruments: Trading in highly speculative markets or instruments (like binary options) may not be suitable for Islamic traders.

Challenges in Islamic Forex Trading

While the concept of Islamic forex trading is appealing, traders may face challenges, including:

- Limited Options: Not all brokers offer Islamic accounts, making it challenging to find suitable trading platforms.

- Complexity of Regulations: Navigating the complexities of Shariah compliance can be daunting for traders unfamiliar with Islamic principles.

- Market Volatility: Forex trading is inherently risky, and market volatility poses a significant challenge, requiring careful management and adherence to Islamic principles.

Final Thoughts

Islamic forex trading presents a unique opportunity for Muslim traders to participate in the global currency markets while remaining faithful to their beliefs and values. By choosing Islamic accounts and adhering to the principles of Islamic finance, traders can navigate the complexities of forex trading in a manner that is both ethical and compliant. As the forex market evolves, so too will the opportunities for Islamic traders to engage and thrive within this dynamic environment.

Always remember that education is key in forex trading. Continuous learning, self-discipline, and adherence to Islamic principles will guide you on your trading journey while ensuring that your investments remain halal.